查看更多>

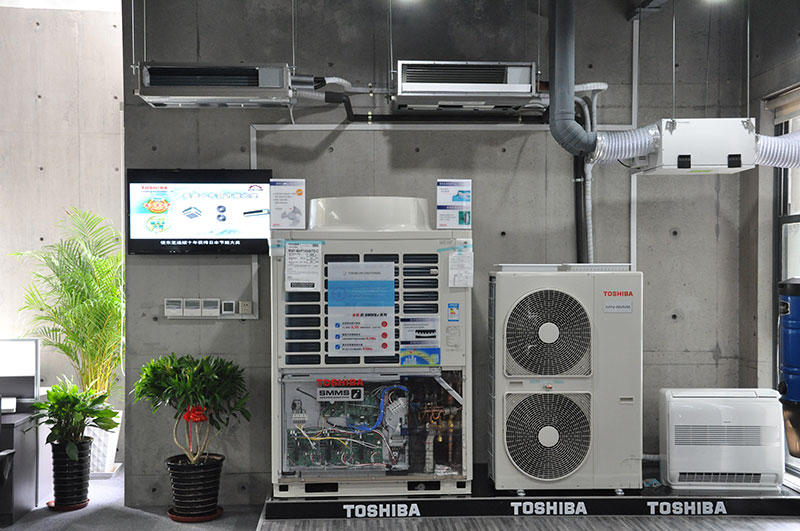

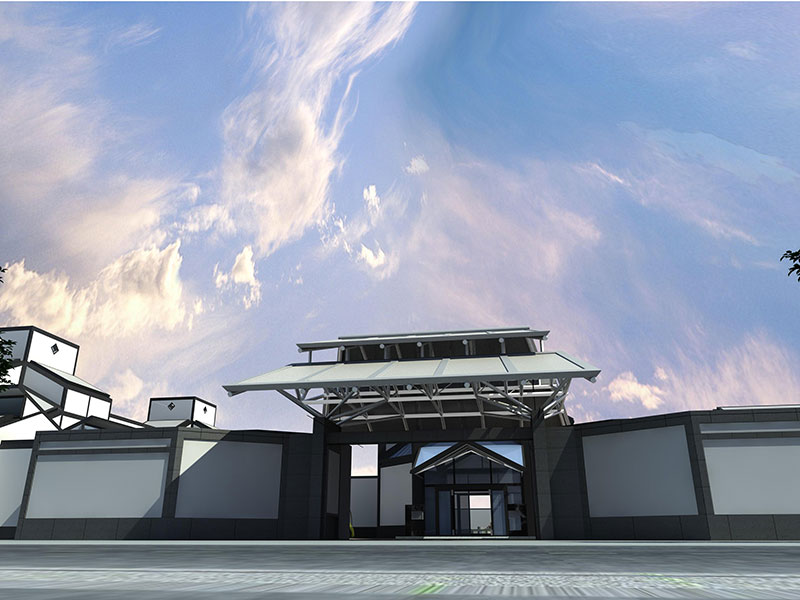

产品展示

/ PRODUCT

查看更多>

新闻资讯

/ NEWS28

12

如何选择合格的装修公司呢?相信在装修初期的准备阶段,这个问题一定困扰了不少人,找到好的看山建筑装修公司就意味着整个装修工...

- 2021/12/28如何选择合格的中山建筑装修公司

- 2021/12/28好的中山建筑装修公司该具备哪些条件:

- 2021/12/28中山建筑装修公司提示:装修必须有主见 7种心态最易吃...

28

12

房价的不断上涨,越来越多的人用大半积蓄买房,在拿到房子的喜悦过后,想把一个毛胚房变成温暖的小窝,还需要一段煎熬的道路——...

- 2021/12/28中山建筑装修公司装修小常识

- 2017/01/17乐竞官网成功上线